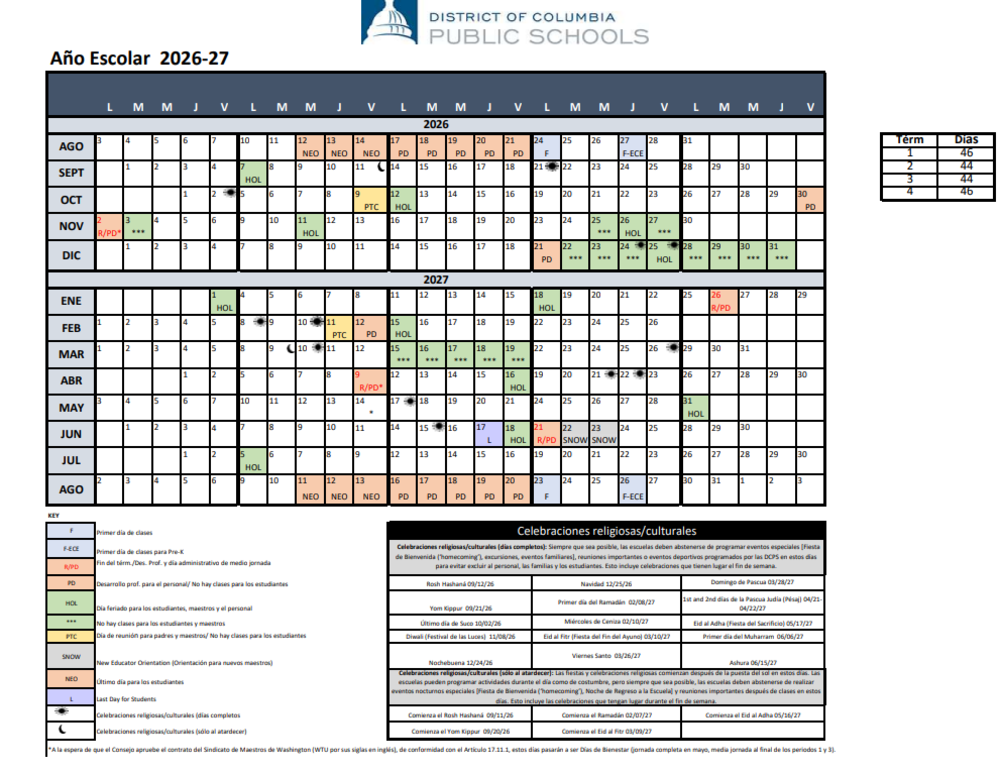

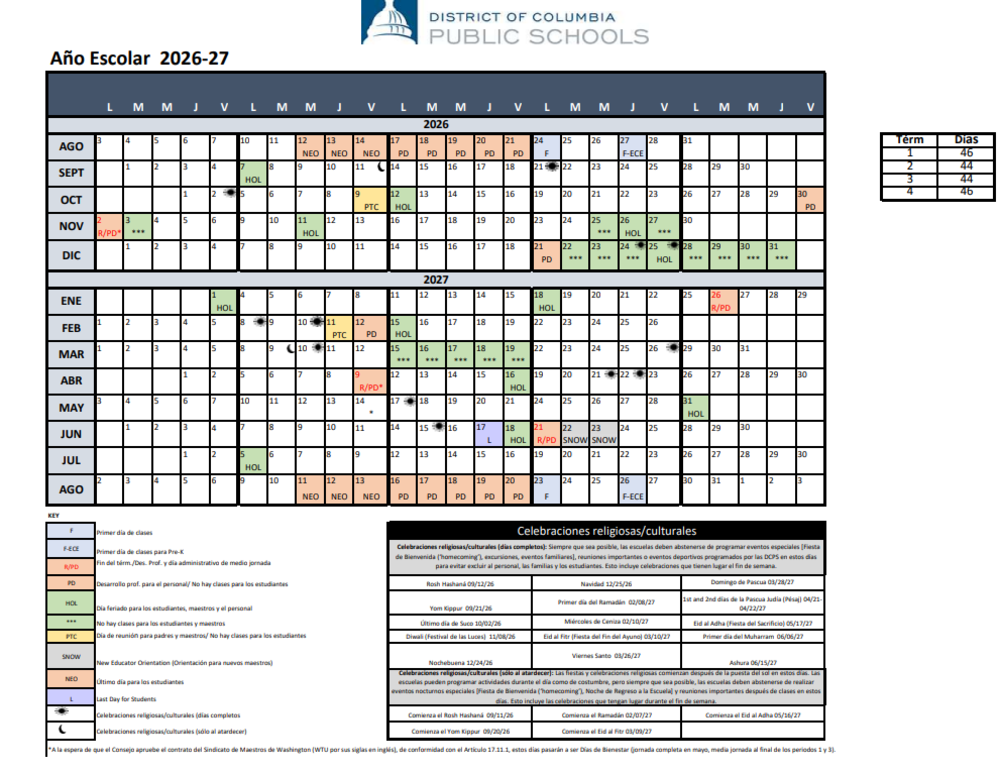

Dcps 2026 To 2026 Calendar Printable Dcps Finest Ultimate Prime. A deduction with respect to the defined contribution pension scheme (dcps) can be claimed under section 80ccd(1) of income. Dcps is defined contribution pension scheme it is nothing but national pension scheme.

Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax. Dcps is defined contribution pension scheme it is nothing but national pension scheme. Whether the total dcps contribution is.

Source: terrymmarrero.pages.dev

Source: terrymmarrero.pages.dev

2025 26 Dcps Calendar 18 19 Terry M. Marrero Whether the total dcps contribution is. Dcps is defined contribution pension scheme it is nothing but national pension scheme.

Source: suncatcherstudio.com

Source: suncatcherstudio.com

Free Printable 2026 Yearly Calendar Free Printables, Monograms Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax. A deduction with respect to the defined contribution pension scheme (dcps) can be claimed under section 80ccd(1) of income.

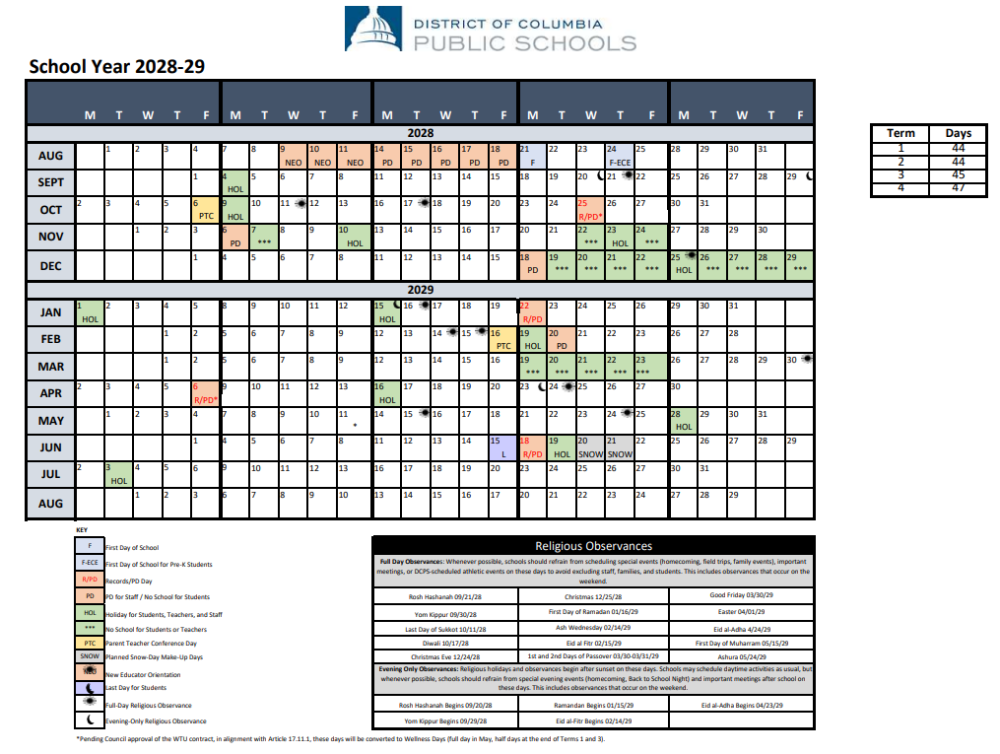

DCPS Calendar 20262029 Feedback PublicInput Dcps is defined contribution pension scheme it is nothing but national pension scheme. Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax.

Source: cassandrezrakel.pages.dev

Source: cassandrezrakel.pages.dev

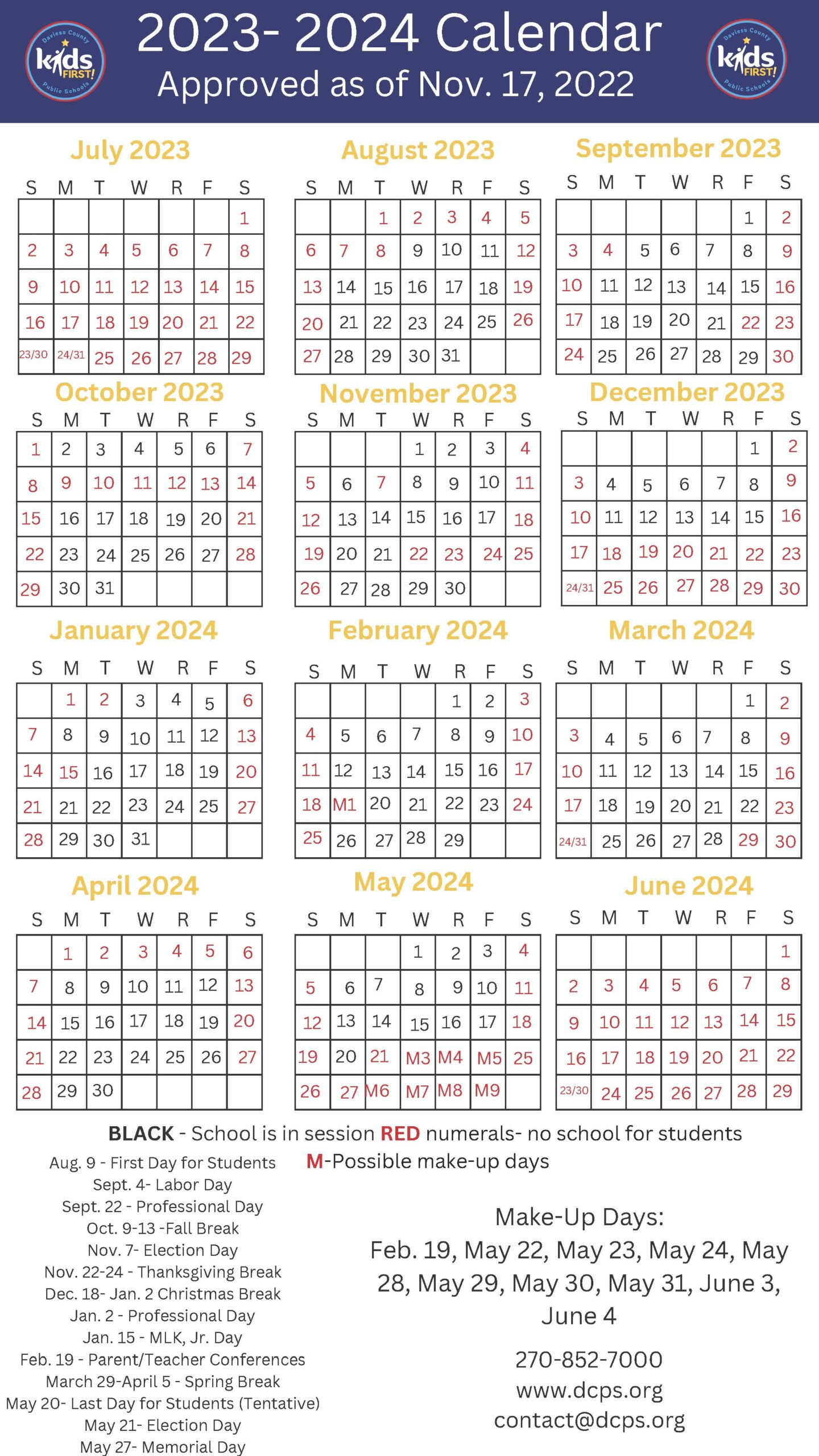

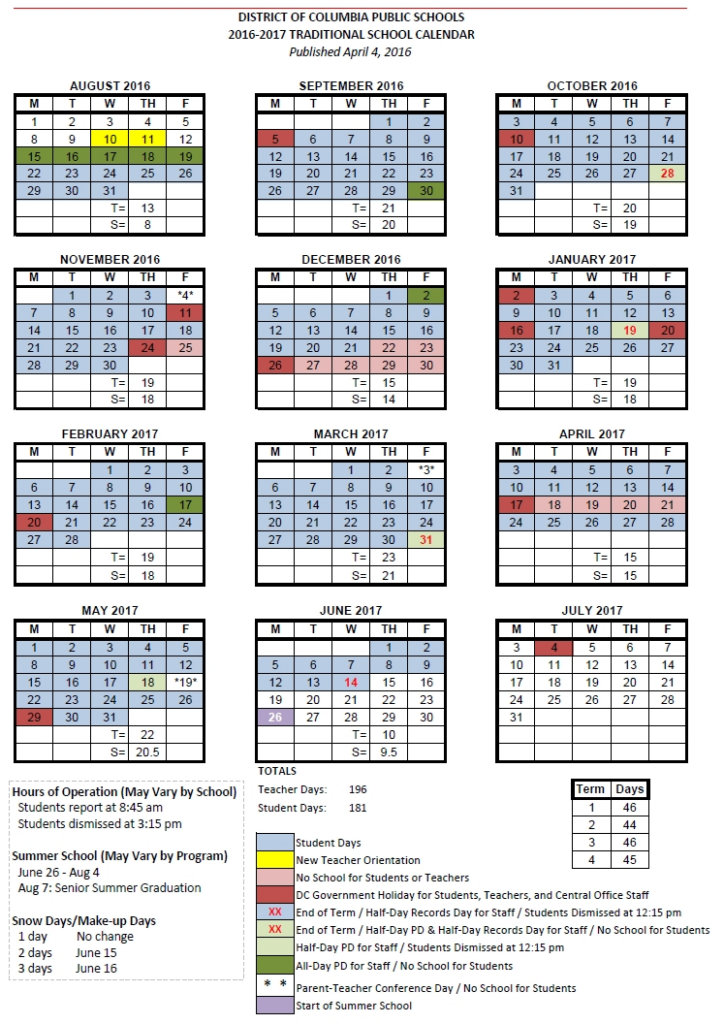

Dcps School Calendar 2024 2025 Becka Carmita The following link gives you the. The bank is deducting 10% of her total salary including da as dcps contribution.

Source: ritalemmet.pages.dev

Source: ritalemmet.pages.dev

Dcps Calendar 2025 To 2025 Rita Lemmet Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax. Dcps is defined contribution pension scheme it is nothing but national pension scheme.

Source: ethylcharlena.pages.dev

Source: ethylcharlena.pages.dev

Dcps Calendar 20252025 Ashli Camilla Whether the total dcps contribution is. The following link gives you the.

DCPS Calendar 20262029 Feedback PublicInput The following link gives you the. Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax.

Source: fanbkimberley.pages.dev

Source: fanbkimberley.pages.dev

Dcps Public Schools Calendar Ketti Meridel Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax. Dcps is defined contribution pension scheme it is nothing but national pension scheme.

2025 26 Dcps Calendar 18 19 Terry M. Marrero Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax. A deduction with respect to the defined contribution pension scheme (dcps) can be claimed under section 80ccd(1) of income.

Source: schoolcalendarpoint.com

Source: schoolcalendarpoint.com

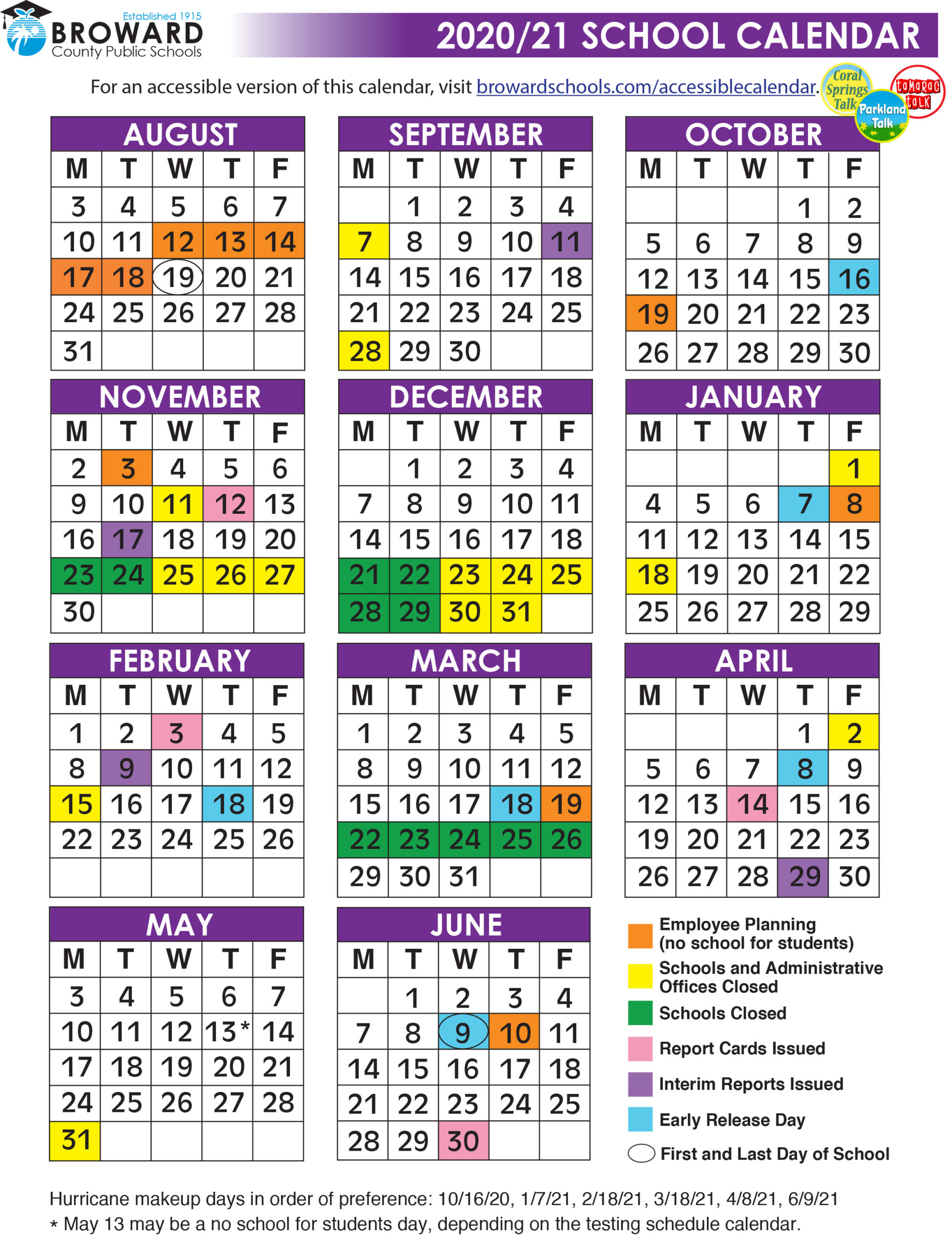

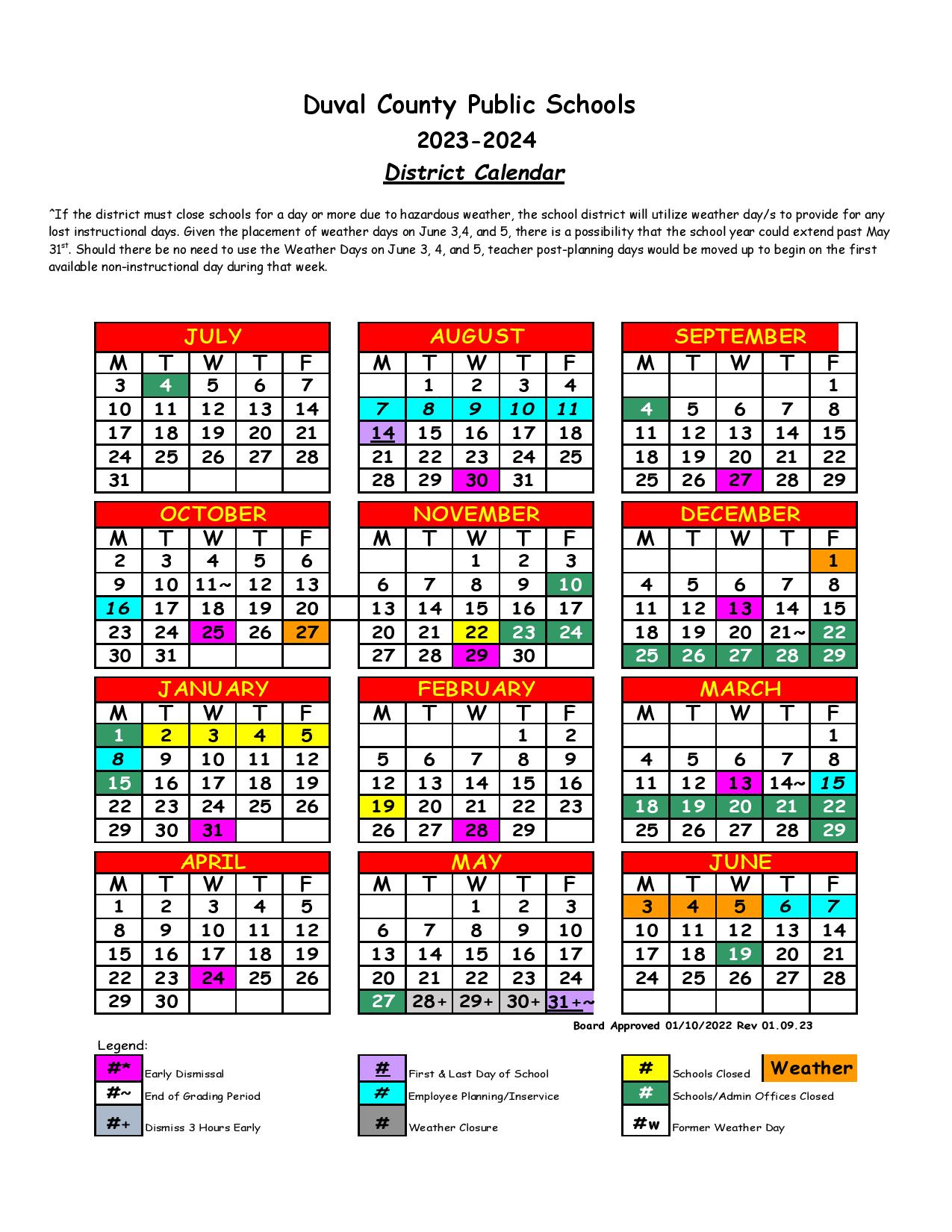

Duval County Schools Calendar 20252026 DCPS Holidays Dcps is defined contribution pension scheme it is nothing but national pension scheme. The bank is deducting 10% of her total salary including da as dcps contribution.

Source: calendar.weloveprintables.net

Source: calendar.weloveprintables.net

2026 BiWeekly Pay Calendar Free Printable Calendar Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax. The bank is deducting 10% of her total salary including da as dcps contribution.

Source: sofiajbertie.pages.dev

Source: sofiajbertie.pages.dev

2025 And 2026 School Calendar Vesd. Sofia J Bertie The following link gives you the. Starting from 1st april 2025, a salaried individual earning up to rs.12,75,000 is exempted for pay tax.